18 March

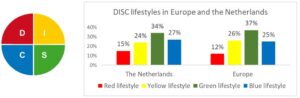

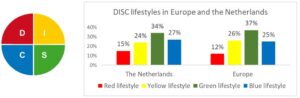

In which way did Corona change the behaviour of consumers and which changes will be long term? How will different lifestyle groups adapt their consumer behaviour after the re-opening of the retail and leisure? Looking to the megatrends affecting the economy, society, and consumption, we can conclude that Covid-19 accelerated most of the ongoing trends. Approaching consumer behaviour during the Covid-19 restrictions as well as post-Covid-19, the DISC behavioural economics method categorising consumers into four or eight different lifestyle categories provides relevant insights and conclusions.

Megatrends in society and consumer behaviour

Figure 1: Mega trends in consumer behaviour Source: Zukuenft Instititut

Putting consumption patterns in a nutshell, in short, the post-World War II retail history can be summarised as follows:

- 1945 – 1980: reconstruction and growth with upcoming consumerism.

Progress in the economy and the society resulted in increases in spending power, and were accompanied by shorter working weeks. Big progress in terms of material wealth with mass ownership of durables like cars, refrigerators, and television sets.

- 1980 – 2010: the digital evolution and individualisation

Three decades of fast digital innovation, starting with computers and items like walkmans. Followed by the establishment of internet and appearance of social media. This led to a fast evolution of possibilities to connect with groups, trace information, and make purchases online.

Over the last decade products like i-Pad and i-Phone as well as You-tube emphasize the centrality of the individual ( i and You), while the 140-character Tweet reduces the possibility for nuance and compromise. Internet and social media provided the opportunity for people to search for like-minded peers and establish platforms against the official media or categorising them as “fake news”. Against this development of prosperity, in recent years we also see disappointment in the political and economic system. The social system that had been carefully constructed in the first half of the last century (a better society for everyone) was pushed into the corner by liberal market thinking, with a decline in solidarity and an increase in polarisation as result.

Looking with a DISC – perspective

The DISC model on behavioural economics is defined by a targeted-individual orientation which emphasizes personal ambition on the left side, and a collective-group orientation on the right side. One of the outcomes of the macro trends sketched above is that group-oriented people have a tendency of evolving into different forms of togetherness, centred around specific topics or issues. These communities can differ per theme. Recent communities against Covid-19 related restrictions, ore the “yellow vests” movement in France are clear examples of this.

One of the main drivers for 21st Century consumer is personal wellbeing. During the first Covid-19 lockdown, this translated into increased spending on durables, most of which could be purchased online. Spending on electronics, DIY, and furniture increased. Grocery shopping mushroomed as well, with people buying more delicatessens and luxury products, as dining outdoor and leisure activities became complicated or even impossible.

However, the satisfaction impact of material compensation declined gradually, and many people were arguing for more personal freedom to go for dining, meet people, and make excursions, combined with less Covid-19 restrictions.

Social distancing and remote working also resulted in a shift in dress code and social conventions, with people appearing more casually dressed and a sharp reduction in the use of office outfits.

Toward post-Covid

With vaccination advancing gradually and no obvious appearance of vaccine-resistant Covid-mutations so far, a re-opening of the economy and society comes in sight. Key question is how consumers will react when lifting of restrictions start. Some key scenarios are:

- Regained freedom. Looking back to previous crises, consumers will prioritise those activities and products which were mostly missed during the lockdown. The fact that Covid-restrictions led to an increase in household savings implies that at least a part of the households will be able to increase their spending.

- Focus on personal care and wellbeing. Consumers are increasingly desperate to go to the hairdresser and beauty salons, as well as going back to restaurants and cafés to meet friends on the terrace.

Likely Post-Covid trends can be summarised as to meet instead of social distancing, fun instead of restraint, consuming instead of saving, exploring instead of purchasing. Some scenarios go as far as referring to the post-Covid period of ‘Roaring Twenties’, following a prolonged period of restraint.

Online or back to the high street?

A general view is that the accelerated increase in online purchases in the aftermath of Covid-19 is there to stay. Consumers got more used to making purchases and delivery logistics underwent a phase of rapid development. Online reviews and price comparisons are easy to find, online shops are open 24/7, and home delivery is still heavily subsidised by the vendors. Instrumental non-emotional purchases in which the shopping experience plays a limited role are likely to be increasingly made online.

However, shopping is not only about making purchases. The experience, spending free time, the search for something new, and see & to be seen are essential elements of shopping. These elements will be relevant whether visiting a prime high street, but in certain degree also when visiting a nearby convenience centre. This can be summarised as the four E’s for market places:

- Experience (experience, having a good time)

- Expertise (instore knowledge, stylists, advice, trust, loyalty)

- Exploration (exploring, discovering, browsing)

- Excitement (having fun, giving yourself or others a treat)

For retailers and marketplaces, such as highstreets and shopping centres) having good scores or one or more of these E’s is essential to be able to stay relevant for the increasingly digitalised consumer. Here, brick and clicks go hand in hand. Retailers are becoming rapidly multi-channel with fully integrated physical and online outlets. The experience of marketplaces has an online dimension next to the physical core, with social media communities and marketplaces not only providing a location to retailers and Food and Beverage (F&B) operators, but also an online platform.

Outlook for 2021 and 2022

While general scenarios and tendencies are gradually more clear, what are going to be patterns in 2021 and 2022, and how will that impact individual retail locations. Direction can be generated by describing impacts for the several DISC-groups and translate that into consumer behaviour. Key questions for the period after re-opening are:

- Who will have more to spend because of increased savings, and who will have less to spend because of loss of job or income?

- Who will be focused more on material purchases at retailers and services, who will be more focused on experience purchases such as F&B, excursions, and travelling?

- Who will be more willing to spend, and who will take a more cautious approach?

- And what is the risk perception? Who will take regained freedom more enthusiastically, and will take a more risk averse approach?

In the internationally widely used DISC model, four lifestyle groups are distinguished: Red, Yellow, Green and Blue. This analysis is based on these four main groups, although a further division into eight customer types is also possible for the Dutch situation.

The Red lifestyle

This group includes relatively more people with a profession in the creative sector, flex workers and employees with a temporary contract. The group of young people is also relatively larger here. As a result, there is more uncertainty about the job situation, and the Covid-19 pandemic has had a greater impact. Consumption in the coming years will depend strongly on the available budget, which may have fallen sharply. Sharp choices are made, focus remains product-oriented. (only buy what you really want) This group has in general been strongly affected by the fact that it was no longer possible to travel, or to visit festivals and events. This will have a strong focus in the coming period. Of all target groups, the Red target group is in retail most focused on the online channels.

The Yellow lifestyle

Consumers with a Yellow lifestyle relatively often have support professions and a part-time contract. In healthcare, but also often in catering or retail. As a result, there has been more than average uncertainty about the work situation in the past year. Consumers with a Yellow lifestyle have a trendy or contemporary lifestyle. They like to shop and are clearly focused on promotions. When shopping becomes fully possible again, they will be happy to do some leisure shopping to spend part of their savings. That is more or less an “indulgence budget” for them. This group is convenience oriented and less loyal to brands.

The Green lifestyle

People with a Green lifestyle often have a permanent employment. In government services, teaching, or in technical professions. As a result, there is less uncertainty about the work situation, and the Covid-19 pandemic has had relatively less impact on the income of this group. People with a Green lifestyle are generally cautious by nature and opt for safety and security. They will therefore have undertaken few leisure activities in the past year and have mainly done their daily shopping in their own neighbourhood. The Green target group does not have an exuberant spending pattern and is most focused on physical stores. After the pandemic, they will show limited catch-up demand.

The Blue lifestyle

Consumers with a Blue lifestyle more often have a management position or work in commercial businesses and -services. They usually have a full-time contract and are less than average insecure about their job or work situation. An important exception to this applies to entrepreneurs and independent professions. These consumers are very fond of a comfortable and somewhat luxurious lifestyle. In retail this can be seen in their focus on brands, quality and service. In leisure, this is especially evident in visits to the better restaurants, theatres and museums. The Blue target group spends relatively more than average online.

As soon as the Covid restrictions are relaxed, it is expected that especially the Yellow and Blue target group will make full use of the newfound freedom. The (relatively small) Red target group will also want to participate in this as far as possible. The Green target group will initially remain cautious.

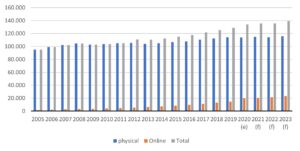

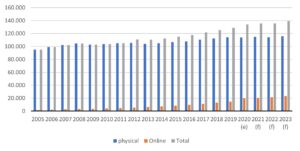

Based on this lifestyle orientation, it can be expected that online spending will continue to grow, with percentages that were seen more often before the Covid pandemic, 10 – 15% for the pure online players and 20 – 25% for the multi-channel retailers.

Retail sales Netherlands (*mn Euro): instore, online and total

Source: Global Data

For the retailers in the high streets it is especially important to focus on the four E’s. In the Netherlands, the total retail floor space remained the same at 27.4 million m2 between 2015 and 2020. A small shift can be seen from non-food to food. The shift from offline to online will put further pressure on sales per m2, which will not be offset by the extra consumer spending. Shopping streets remain attractive especially if vacancy has as little impact as possible on the retail experience of the consumer.

(pdf Retail post Corona: going back to the high street)

Quote Herman: “I also believe firmly in the role of cities and core central urban areas,” he told Real Asset Insight’s Richard Betts. “Offices and core central urban areas are the places where people meet and interact, where creative ideas are established and where young people build their careers”. (you tube link 1 minute)

More information: please email

herman.kok@discvision.nl

andre.doffer@discvision.nl